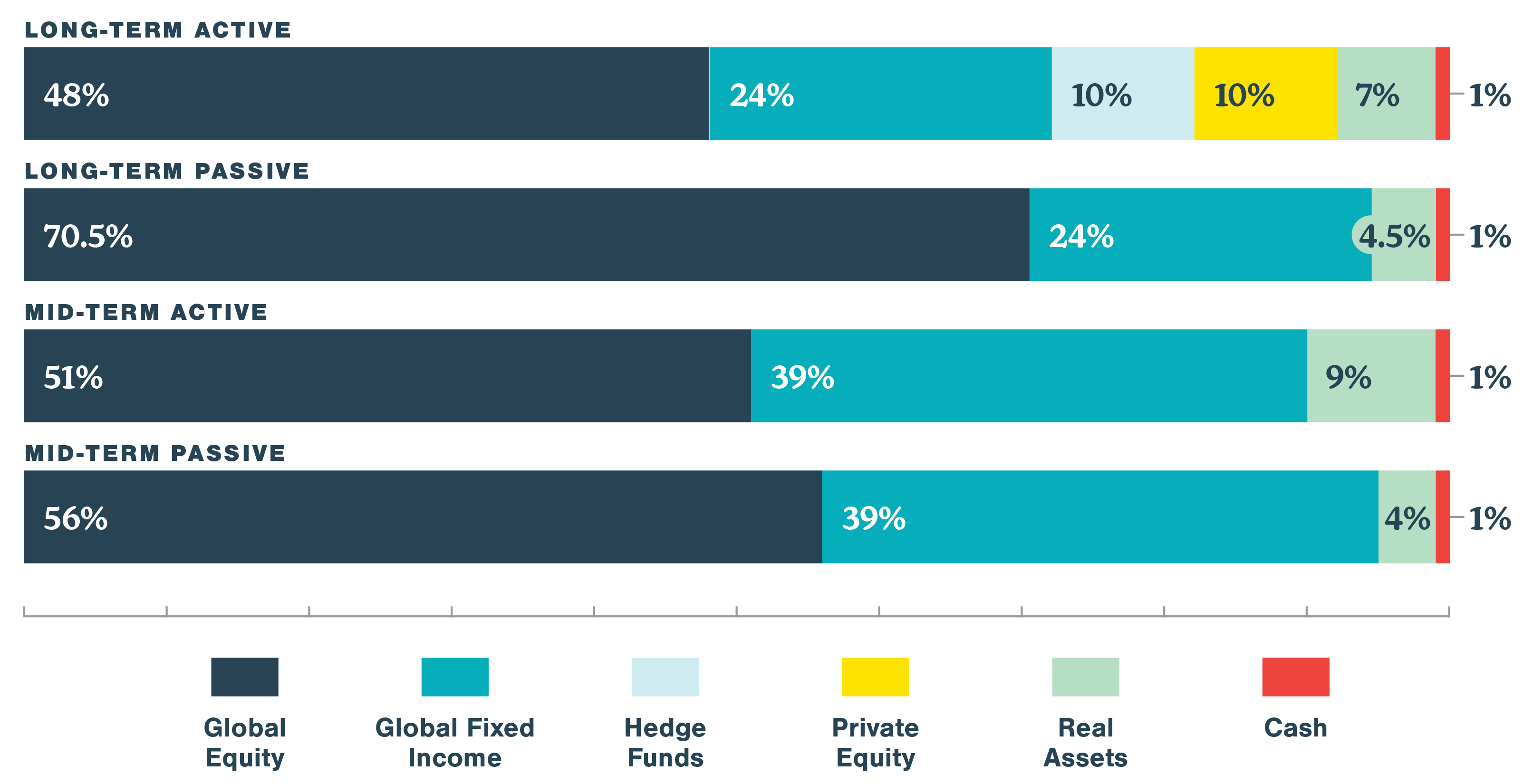

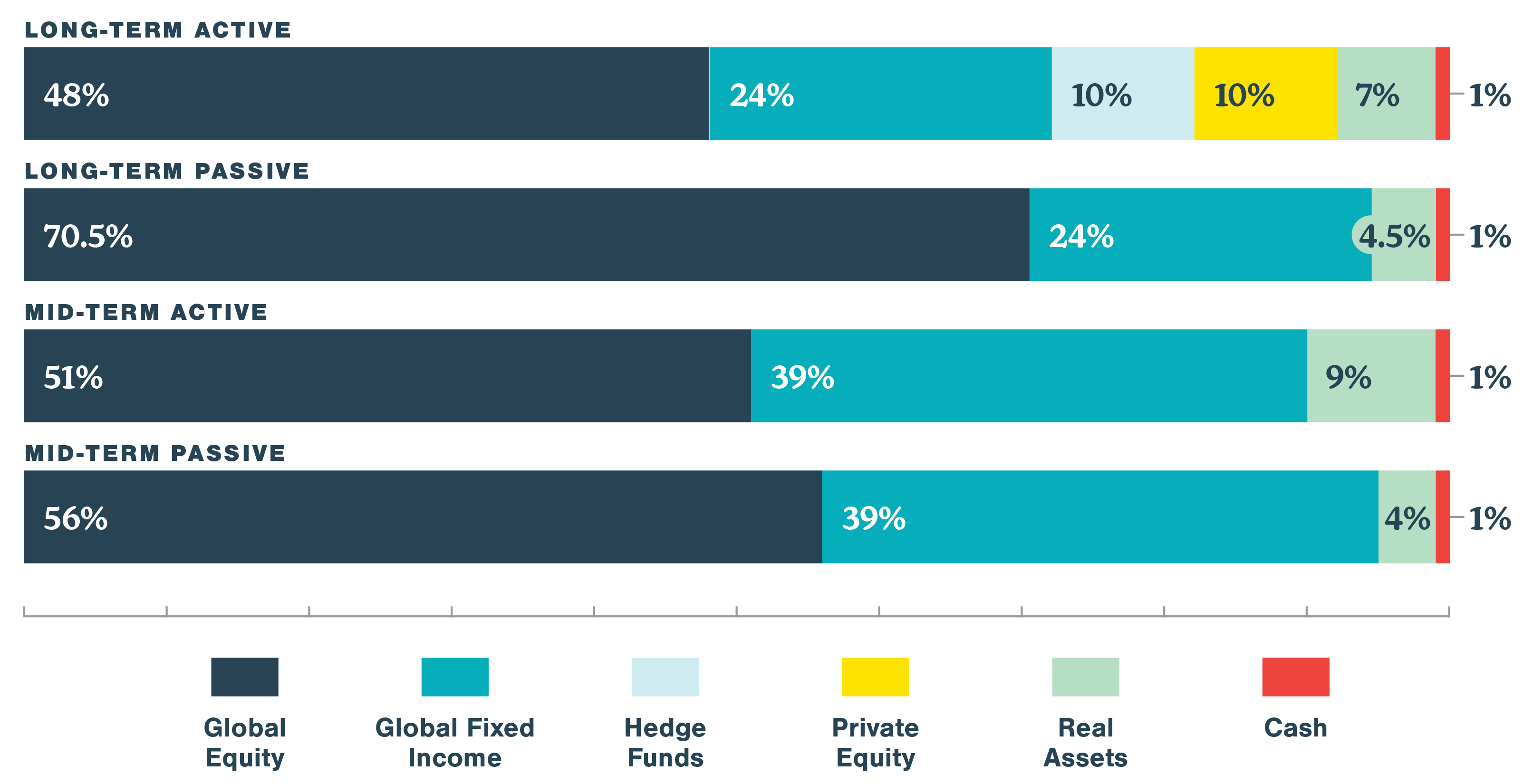

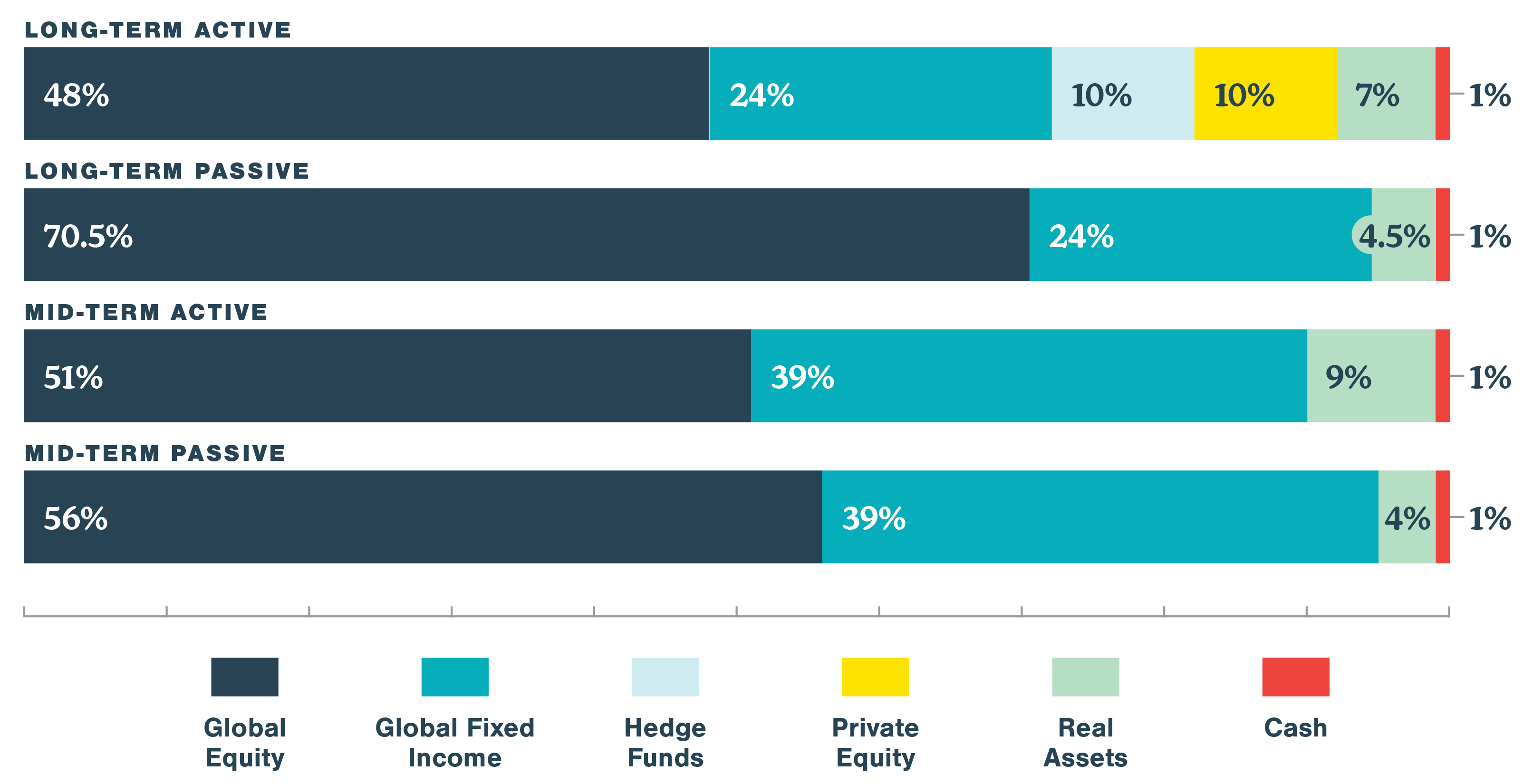

Investing charitable dollars is an important part of our work. At ACF, we offer tailored investment strategies designed to align with your giving goals, while providing transparent insights into the Foundation’s financial health. We understand that each donor’s situation is unique, which is why we offer four diverse investment pools to meet a range of objectives. Alternatively, you can retain your current investment manager, with some limitations.

Hosted by our investment advisor, Fiducient Advisors, this presentation provides insights into market and investment pool performance over the past six months and discusses impacts related to the Foundation’s long-term investment strategy.

Our investment committee is comprised of seasoned investment and business professionals. With the aid of our investment counsel, Fiducient Advisors, the committee formulates overall investment policy, determines strategic asset allocation and choice of asset classes, hires money managers, and monitors and evaluates investment performance.